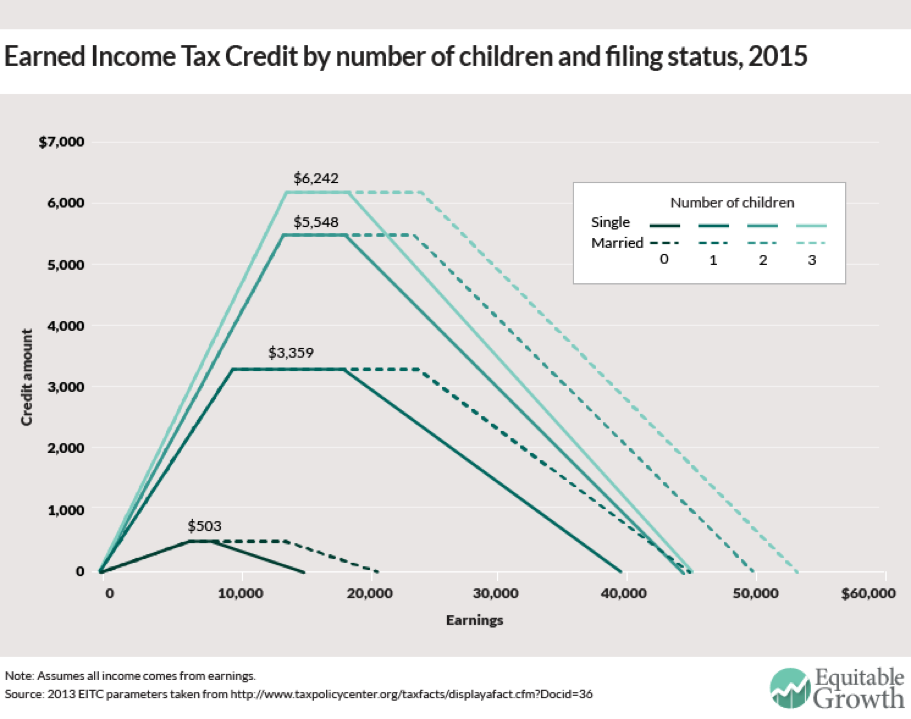

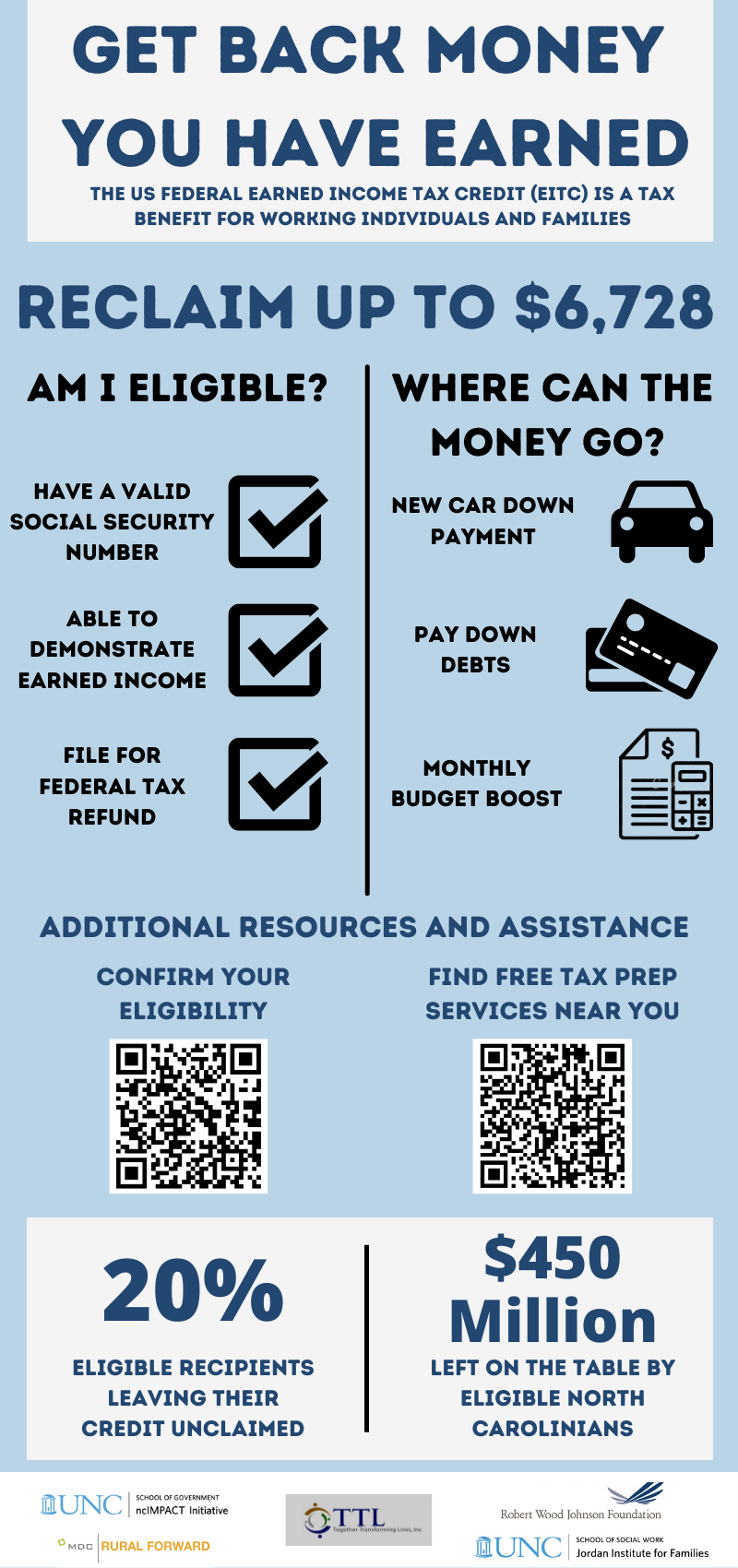

Eitc Changes For 2025. (a) in income tax act 1961 only ca can audit the books of account but in direct tax code 2025, there is a possibility that cma and cs also can audit the books of account. The maximum eitc for families with three or more children has been raised to $8,046.

For single taxpayers and married individuals filing separately for tax year 2025, the standard deduction increases to $15,000 for 2025, up $400 from 2025. For tax year 2025, the.

What Is The Eitc For 2025 Brook Collete, The top 10 federal tax law changes for 2025 include updates to.

When Does Eitc Start 2025 Angela Allan, In this article, we will explore the upcoming tax credit changes for 2025, how they could impact you, and what steps you can take to make sure you’re prepared.

When Does Eitc Start 2025 Angela Allan, For example, in its announcement tuesday, the agency said it raised the maximum amount of.

2025 Tax Calculator Federal Irene Howard, The top 10 federal tax law changes for 2025 include updates to deductions, tax brackets, credits, and more.

Eitc Refund Schedule 2025 Arlyn Caitrin, In addition to inflation adjustments and the eitc updates this year, other credits will receive expansions and adjustments.

Eitc 2025 Release Date Keith Duncan, Union budget 2025 is seen as a decisive moment for india to drive sustainable growth, enhance its taxation framework, and boost global competitiveness.

Who Qualifies For Eitc In 2025 Joannes Anderson, The maximum eitc for families with three or more children has been raised to $8,046.